A Strategic Partner's Guide to Adding Customer Value

How identity and privacy protection can win your customers' loyalty

Guide Summary: Consider this your starting place for everything you need to know about increasing customer engagement and loyalty with the latest in consumer privacy protection tools and identity protection technology.

# The rising demand for identity monitoring and consumer privacy protection

It's a competitive world for today's companies. Everyone's scrambling to be different, be better, be a leader—tough to do in a marketplace packed with endless choices. If a customer doesn't like one option, they'll simply click and buy elsewhere.

But consumers are also struggling. They're intensely uncertain about their future and the well-being of their families. Businesses that can win consumers' trust in these unsettled times will stand out from those that don't. According to a recent Edelman consumer trust survey, 81% of respondents say brand trust has become more important because of "personal vulnerability" regarding their health, financial stability, and privacy.

In this guide, we'll take a look at the privacy and identity vulnerabilities worrying consumers and the services that are available to protect them. We'll also explore how strategically partnering with a reputable identity and privacy protection provider brings value to your customers and your business. Finally, we'll also share what to look for in consumer privacy and identity protection.

Privacy threats put consumers at risk

Consumers have good reason to worry about data privacy, which is the ability to control how personal information is gathered, used, and shared. It's also the power consumers have to choose who can contact them – such as through unsolicited emails – and who can watch them.

Consumers' personal data is a valuable asset

The websites consumers visit, the apps they use, and the digital companies they do business with all collect personal information. That's fine – people willingly trade personal data for access to content, games, and networks. Too often, however, this information is harvested from the free products and services consumers use and acquired by other, non-related private, public, and commercial entities.

This results in the loss of rights and control of personal data where the individual cannot guarantee control over how their data is being used. The problem amplifies when the second party sells this personal data to third parties who combine it with more data—so-called data brokers. It's no wonder, then, that eight in 10 Americans say they have little or no control over the data that is collected on them and think the risks of having that data collected outweigh the benefits.

Private data often falls into the wrong hands

Hackers are another privacy threat. According to one estimate, an average of 13.9 million social media records a day were compromised during a six-month period. Some of the most common social media threats include:

- Phishing scams, in which users are tricked into clicking on infected links or scams

- Malware

- Account takeover

- Bots used to steal data or send spam on social media

- Social media impersonation, in which someone creates a fake social media account in another user’s name

Privacy risks multiplied when COVID-19 shut the world down. Since the stay-at-home orders began, IDX's members have experienced a 50% increase in the number of targeted scams and phishing attacks via email, call, and texts.

And hackers also use the popular videoconferencing platforms like Zoom to invade a person's privacy and expose consumers—and their children—to malicious content. According to NPR, Zoombombers intruded on an Alcoholics Anonymous meeting, a Sunday school, online college classes, and a city meeting. Teachers transitioning to remote learning have been particularly affected by this trend.

Identity theft causes consumers financial, emotional, and even physical harm

A consumer's digital privacy directly influences identity security – and vice versa. For example, hackers can use personal information exposed during a phishing scam to commit financial fraud. The FBI’s Internet Crime Complaint Center (IC3) reported more than $3.5 billion in losses to both individuals and businesses, much of that from phishing and similar tactics.

Data breaches that expose personal information are another threat that can also result in identity theft, a crime that occurs every 2 seconds. These identity crimes include:

- Financial fraud. Criminals use stolen credit cards or card numbers to purchase goods and services. If undetected, credit card fraud can damage a victim's credit rating, wipe out their accounts, and affect their ability to take out auto, home, or college loans.

- Medical identity theft: When a criminal steals health insurance information for their own use, the victim may be financially responsible for medical services they never received or be denied future coverage. Even worse, the thief's medical diagnosis and treatment could be added to the victim's healthcare record, leading to dangerous misdiagnosis or mistreatment.

- Employment fraud. Fake or stolen IDs are sometimes used to get jobs by those with a criminal history that would show up in a background check. Victims learn about this kind of theft when they receive a W-2 from an unknown employer or a Social Security statement that doesn’t match their employment history. Criminals also file unemployment claims with stolen Social Security numbers or other personal information.

In 2019, consumers lost more than $1.9 billion to identity theft and fraud, according to the Federal Trade Commission. The U.S. Department of Justice reports that identity theft costs victims who experienced a financial loss an average of $1,343. And an Identity Theft Resource Center survey found that:

- Almost 40% of victims used savings to address their needs.

- Nearly 43% went into debt.

- Almost 41% could not pay their bills.

It takes an average of six months and 100 to 200 hours to resolve identity theft cases–if they ever are. With the endless onslaught of identity and privacy threats, consumers need solid protection and peace of mind. And today's savvy businesses are stepping up and answering the call.

# How identity and privacy protection provides added value to your customers

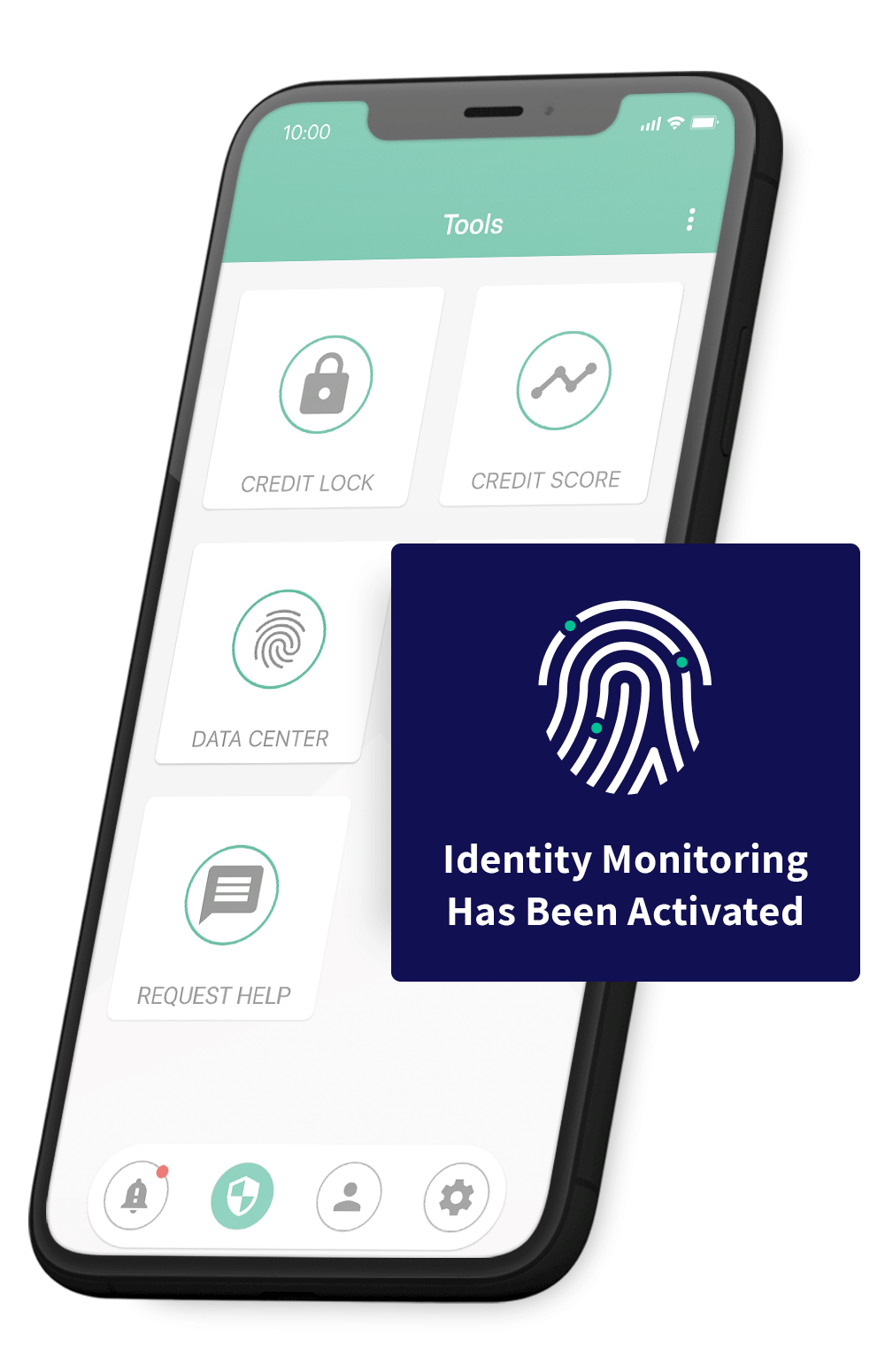

Digital data protection is a broad category of identity and privacy tools and technology that help customers protect their identity and privacy online. Here's a quick breakdown of what leading providers offer their customers:

Monitoring and Alerts

Identity protection includes monitoring to quickly alert consumers if their identity is at risk. Early detection helps prevent identity theft from becoming a problem – or at least lessening the damage if it does occur. An identity protection plan should include:

- Credit monitoring with at least one of the three major credit bureaus, to alert consumers of changes in their credit profile that might indicate criminal activity.

- Change of address monitoring to warn individuals if someone's having their mail redirected.

- Social Security fraud monitoring alerts consumers when their Social Security number has been exposed.

- Dark web monitoring warns consumers if their passwords, account numbers, Social Security number, or other personal information are posted on the dark web for criminals to use.

- Social media monitoring to scan social media profiles and connections, alerting individuals to malicious content or links, account impersonation or takeover, scams, fraud, and inappropriate content.

If something is wrong, your consumers will receive fraud alerts via email or mobile apps and be advised on what actions to take – such as placing a credit freeze.

Identity Recovery

Privacy and identity protection should also include identity recovery, the most important part of this service. A consumer victimized by identity theft needs fast, expert help to minimize damage and prevent further problems. Trained recovery advocates know who to contact and how to work with law enforcement, government, medical providers, and businesses to shut down fraudulent accounts and transactions, clean up records, and clear a victim's name. An advocate committed to completely restoring a victim's identity can help prevent significant losses and eliminate the need to file an insurance claim and wait for payment.

Reimbursement Insurance

Most identity protection plans offer insurance – usually up to $1 million – to cover any out-of-pocket expenses related to identity recovery. While typical out-of-pocket recovery expenses are in the hundreds of dollars, the extra coverage offers your consumers peace of mind.

# Examples of how consumer identity and privacy protection helps consumers

All these services are important, but to see their real value, it's crucial to know how they can truly help your customers. The following experience from an IDX member is an excellent example of identity and privacy protection in action:

With identity and privacy protection in place, this victim was alerted to suspicious activity and could quickly access expert help to resolve fraud—stopping the problem before it got worse. The recovery advocate also taught this member how to better protect their credit and identity in the future.

# How identity and privacy protection coverage adds value to your brand

With so many Americans working and learning remotely for the long term, digital data protection is a must. Working from home (WFH) naturally increases security weaknesses. They use personal devices for business, are vulnerable to numerous scams, and often connect to company systems using less-than-secure home networks. Sensitive personal and company data are at risk for data breaches, fraud, and privacy compromises.

Identity and privacy protection is a logical service to offer in these unprecedented times. And it's a service that shows your customers and members that you understand what they need right now and you want to help. By offering digital data protection as a free or discounted service, you can:

Improve customer stickiness and build loyalty

To encourage customers to "stick" with your brand, marketing experts recommend being useful with helpful, high-value products, and by creating an emotional appeal. Identity and privacy protection gives worried consumers peace of mind while genuinely helping through actionable alerts, recovery services, and educational content. Such protection could be a perk of your customer loyalty program.

Create a new customer engagement trend

A new service such as digital data protection can support your customer acquisition strategies. You could bundle this protection as part of a new package of checking services or add free protection for one year when a customer opens a new online trading account.

Improve customer lifetime value (CLV)

Customers with high CLV can be your most valuable. To maximize CLV, you could adopt a recurring revenue model that sets up a lifetime of customer touchpoints – each of which is an opportunity to win revenue and loyalty. One of these interactions might be a discounted promotion for another product or service – such as digital data protection.

Generate new revenue streams

Think about how you can add value. Members of LendingTree, the nation’s leading online loan marketplace, automatically receive dark web monitoring from IDX. They can receive further protection with monthly subscription packages at special rates available only to My LendingTree users.

Identity and privacy protection is more than a nice-to-have. It's a must-have for your vulnerable customer and members, and a great way to add value to your brand.

# What to look for in consumer identity and privacy protection

The market is flooded with dozens of identity theft protection services, from free credit monitoring to more complete services – such those providing identity restoration and privacy monitoring. Choosing the best option for your customers or members may seem overwhelming, but it doesn't have to be. While sifting through product descriptions, customer satisfaction ratings, and pricing plans, consider:

Scalable coverage for any size group

Look for a solution that can support your growing customer base, whether that's 100 or 100,000 people. Can the provider offer fast, reliable service, even as more customers enroll or as new features are added? Identity and privacy technology built on cloud architecture easily scales. And many cloud solutions are offered on a subscription basis (SaaS), which means they automatically provide all software updates without disrupting service to your customers.

Customizable level of engagement

The best protection is personalized to the customers it's meant to serve. Customers who are new to identity and privacy protection may want to start with a single feature, such as by monitoring their email on the dark web, and try new capabilities later on. And since nearly half of web traffic in the U.S. is mobile, the service should be optimized for both mobile and desktop users.

Flexible plans and opportunities to differentiate

You should be able to decide how you offer identity and privacy protection, such as whether as a free or discounted service. And to build trust and credibility with your customers, you may choose to white-label the service – that is, put your branding, logo, and identity on it.

Fast speed-to-market and easy rollout

Adding identity and privacy protection as a free or discounted service benefit should be easy and tailored to fit your needs, so look for a turnkey solution. A step-by-step roll-out plan and seamless integration with your existing platform eliminate any heavy lifting on your end.

Personal, expert-level member support and customer service

Whether they have a simple question or need full identity recovery, customers deserve a trusted, go-to source for all their identity needs. Look for the hallmarks of excellent service, such as providing the same dedicated agent for each incident. The best providers also educate your customers with customized articles and other content, including news of the latest risks, best practices, privacy protection trends, and expert advice.

Sparkling reputation and great member reviews

Who else does the provider serve? A client list can speak volumes. For example, if the provider supports government agencies, you know the solution is built to rigorous security standards. Don't forget to check their member reviews too. That will tell you how happy they'll keep your customers.

Working from home...phishing scams...data breaches. It's a dangerous world for your customers' identity and privacy. Join top companies who are taking the lead in safeguarding their customers from these risks with digital data protection—and adding significant value to their brand along the way.